Embark on a journey through the realm of top travel insurance companies, where safety meets convenience and peace of mind reigns supreme. As we delve into the world of travel insurance, a plethora of options awaits, promising protection and security during your adventures.

Exploring the various aspects of coverage, claim processes, customer service, and cost, we aim to equip you with the knowledge needed to make informed decisions when choosing the right travel insurance provider.

Research Methodology

When evaluating the top travel insurance companies, several criteria are taken into consideration to ensure a comprehensive ranking. Factors such as coverage options, customer service, claim process, pricing, and overall reputation play a significant role in determining the top performers in the industry.

Criteria for Evaluating Top Travel Insurance Companies

- Coverage Options: The range of coverage options offered by the insurance companies, including medical coverage, trip cancellation/interruption, baggage loss/delay, and emergency evacuation.

- Customer Service: The quality of customer service provided by the insurance companies, including response time, availability, and helpfulness of representatives.

- Claim Process: The ease and efficiency of the claim process, including how quickly claims are processed and paid out.

- Pricing: The affordability of the insurance plans offered by the companies in comparison to the coverage provided.

- Reputation: The overall reputation of the insurance companies based on customer reviews, industry awards, and financial stability.

Sources Used to Determine the Ranking

- Industry Reports: Utilizing industry reports and analysis to gather data on market trends and performance of insurance companies.

- Customer Reviews: Taking into account customer reviews and ratings on platforms such as Trustpilot, Consumer Affairs, and Google Reviews to understand the firsthand experiences of policyholders.

- Expert Opinions: Consulting with industry experts and professionals in the travel insurance sector to gain insights into the strengths and weaknesses of different companies.

Customer Reviews and Ratings Influence in Selection Process

Customer reviews and ratings play a crucial role in the selection process of the top travel insurance companies. Positive reviews indicate a high level of customer satisfaction, reliability, and trustworthiness, while negative reviews highlight areas of improvement and potential red flags for consumers.

By analyzing customer feedback, insurance companies can continuously enhance their products and services to meet the needs and expectations of travelers.

Coverage Options

Travel insurance companies offer a variety of coverage options to protect travelers from unforeseen circumstances during their trips. Let's explore the different types of coverage provided by the top travel insurance companies and compare their limits for medical expenses, trip cancellations, and lost baggage.

Types of Coverage

- Medical Expenses: Most travel insurance plans cover medical expenses related to accidents or illnesses that occur during the trip. This includes hospital stays, doctor visits, and emergency medical evacuation.

- Trip Cancellations: Coverage for trip cancellations reimburses travelers for non-refundable costs if they have to cancel their trip due to covered reasons such as illness, natural disasters, or job loss.

- Lost Baggage: Travel insurance typically covers lost, stolen, or damaged baggage during the trip, providing reimbursement for necessary items or replacement of belongings.

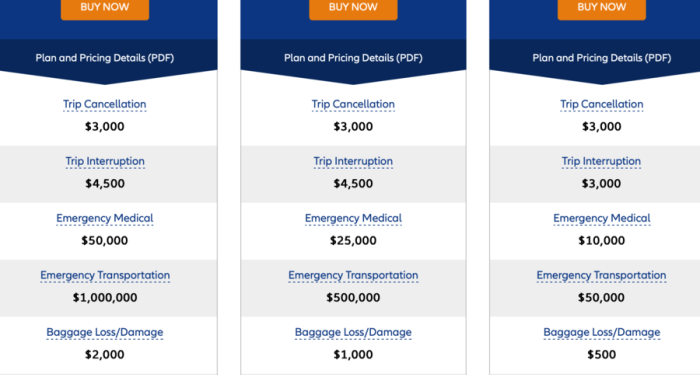

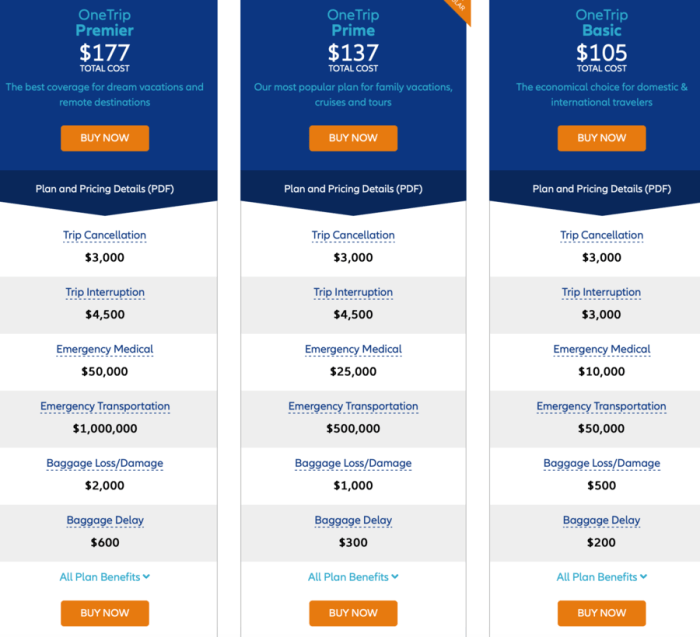

Coverage Limits

- Medical Expenses: The coverage limits for medical expenses vary among travel insurance companies, with some offering up to $100,000 or more for medical emergencies.

- Trip Cancellations: The limits for trip cancellation coverage can range from $5,000 to $10,000 or more, depending on the policy and the total cost of the trip.

- Lost Baggage: Coverage limits for lost baggage usually range from $500 to $3,000 per traveler, with some companies offering higher limits for valuable items like electronics or jewelry.

Specialized Coverage Options

- Adventure Activities: Some travel insurance companies offer coverage for adventurous activities like skiing, scuba diving, or mountain climbing, which may not be included in standard plans.

- Pet Care: Certain companies provide coverage for pet care expenses if a traveler's pet becomes ill or injured while they are away on a trip.

- Terrorism Coverage: In light of global uncertainties, some insurers offer coverage for trip cancellations or interruptions due to acts of terrorism in the travel destination.

Claim Process

When it comes to filing a claim with the top travel insurance companies, the process is usually straightforward and user-friendly. It is essential to follow the specific steps Artikeld by each company to ensure a smooth and efficient claim process.

Documentation Required

To successfully file a claim, you will typically need to provide certain documentation, such as:

- Completed claim form

- Copies of travel documents (tickets, itinerary)

- Receipts for expenses incurred

- Medical reports or police reports (if applicable)

- Any other relevant information requested by the insurance company

Average Processing Time

The average time taken by these top travel insurance companies to process and settle claims can vary. However, most companies aim to settle claims within a few weeks of receiving all the necessary documentation. It is essential to provide complete and accurate information to expedite the process and avoid delays in claim settlement.

Customer Service

When it comes to evaluating the customer service quality of the top travel insurance companies, it is essential to consider factors such as responsiveness, helpfulness, and overall customer satisfaction. Exceptional customer service instances can make a significant difference in a traveler's experience, especially during emergencies or when filing a claim.

The availability of 24/7 customer support and assistance is crucial for addressing any issues or concerns that may arise before, during, or after a trip.

Availability of 24/7 Customer Support

- Many top travel insurance companies offer 24/7 customer support to assist travelers with any questions or emergencies that may arise.

- This round-the-clock availability ensures that travelers can get immediate help, guidance, or information whenever they need it, regardless of the time zone or location.

- Having access to 24/7 customer support can provide peace of mind to travelers, knowing that help is just a phone call away in case of any unexpected situations.

Cost and Value

When it comes to choosing a travel insurance plan, cost and value are important factors to consider. Let's take a closer look at how the top travel insurance companies stack up in terms of pricing and the value they offer to customers.

Cost of Travel Insurance Plans

- Company A offers a range of travel insurance plans with varying prices based on coverage limits and trip duration. Customers can choose a plan that best fits their budget and travel needs.

- Company B provides competitive pricing for their travel insurance plans, ensuring that customers get quality coverage at affordable rates.

- Company C offers customizable travel insurance options, allowing customers to tailor their coverage to suit their budget while still providing adequate protection.

Value Provided by Companies

- Company A stands out for its comprehensive coverage options, including coverage for trip cancellations, medical emergencies, and baggage loss, giving customers peace of mind during their travels.

- Company B prides itself on excellent customer service and fast claims processing, adding value to their travel insurance plans and ensuring a hassle-free experience for customers.

- Company C offers additional value through perks such as 24/7 emergency assistance, concierge services, and access to exclusive travel discounts, enhancing the overall travel experience for customers.

Discounts, Promotions, and Loyalty Programs

- Company A frequently runs promotions and discounts for new customers, making their travel insurance plans even more affordable. Additionally, loyal customers may be eligible for discounts on future purchases.

- Company B offers discounts for bundling multiple insurance policies together, providing customers with cost savings and added value for their insurance needs.

- Company C rewards loyal customers with exclusive discounts, special promotions, and loyalty programs that offer additional benefits and savings on travel insurance premiums.

Closure

In conclusion, navigating the landscape of top travel insurance companies can be a daunting task, but armed with the information provided, you can confidently select a plan that suits your needs. Whether it's for a weekend getaway or an extended vacation, ensuring you have the right coverage is paramount for a worry-free travel experience.

Essential Questionnaire

What is the typical coverage offered by top travel insurance companies?

Top travel insurance companies usually offer coverage for medical expenses, trip cancellations, lost baggage, and emergency evacuation.

How long does it usually take for travel insurance companies to process and settle claims?

The average time taken by travel insurance companies to process and settle claims can vary but typically ranges from a few days to a few weeks, depending on the complexity of the claim and the documentation provided.

Are there any loyalty programs or discounts offered by these companies?

Some top travel insurance companies provide discounts for frequent travelers, loyalty programs for returning customers, and promotional offers during certain times of the year.