Embark on a journey through the realm of travel insurance with a focus on 'travelinsured'. This introduction sets the stage for an informative and engaging discussion, capturing the essence of why travel insurance is essential in today's unpredictable world.

In the following paragraphs, we will delve into the different aspects of travel insurance, from its benefits to choosing the right plan and understanding the claims process.

Overview of Travel Insurance

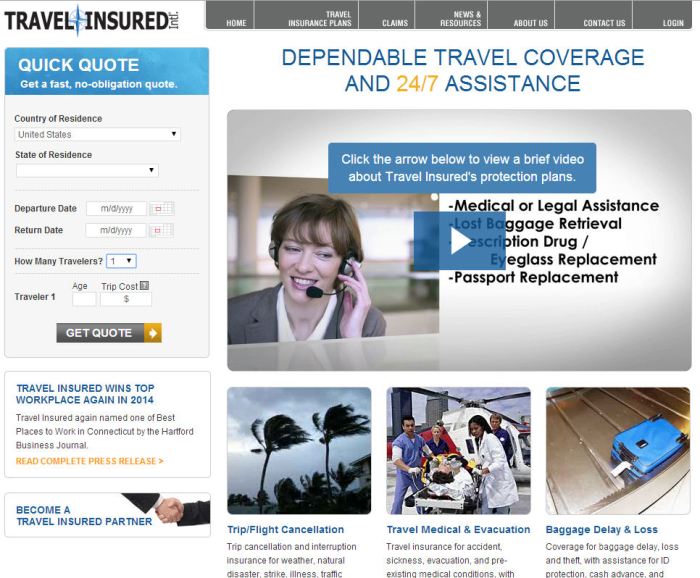

Travel insurance is a crucial aspect of trip planning that provides financial protection and peace of mind in case of unexpected events. It covers a wide range of situations that can arise during travel, ensuring that travelers are not left stranded or facing hefty expenses.

Importance of Travel Insurance

- Medical Emergencies: Travel insurance can cover medical expenses, hospital stays, and emergency medical evacuation, especially crucial when traveling to countries with high healthcare costs.

- Trip Cancellation or Interruption: In cases of unexpected events like illness, natural disasters, or airline strikes, travel insurance can reimburse the cost of your trip.

- Lost or Delayed Baggage: Travel insurance can provide compensation for lost, stolen, or delayed baggage, helping travelers replace essential items or purchase necessities during their trip.

Types of Coverage

- Medical Coverage: Covers medical expenses, emergency medical evacuation, and repatriation in case of illness or injury during travel.

- Trip Cancellation/Interruption: Reimburses non-refundable trip costs in case of cancellation or interruption due to covered reasons.

- Baggage Loss/Delay: Provides coverage for lost, stolen, or delayed baggage, offering reimbursement for essential items or replacement of belongings.

- Travel Delay: Offers compensation for additional expenses incurred due to flight delays or cancellations, such as accommodation and meals.

- Emergency Assistance: Provides 24/7 support for emergencies like medical assistance, legal referrals, or translation services.

Benefits of Travel Insured

Travel insurance offers a range of benefits that can provide peace of mind and financial protection during your travels. Let's explore some of the advantages of having travel insurance:

Financial Protection

- Reimbursement for trip cancellations or interruptions due to unforeseen events like illness, natural disasters, or airline strikes.

- Coverage for emergency medical expenses abroad, including hospital stays, surgeries, and medications.

- Refunds for lost, stolen, or damaged luggage and personal belongings.

Emergency Assistance

- 24/7 access to a helpline for assistance with medical emergencies, travel arrangements, or legal help in a foreign country.

- Repatriation coverage for medical evacuations back home in case of serious illness or injury.

Travel Benefits

- Coverage for travel delays, missed connections, or rebooking fees in case of unforeseen circumstances.

- Protection for rental car damages or liability while driving in a foreign country.

Real-life Scenarios

Imagine you are on a dream vacation when a sudden illness forces you to cancel your trip. Without travel insurance, you would lose all the money you spent on flights, accommodations, and activities. However, with travel insurance, you can file a claim and receive reimbursement for your non-refundable expenses.

Another scenario could involve a medical emergency while traveling abroad. Without travel insurance, the cost of emergency medical treatment in a foreign country could be exorbitant. Travel insurance would cover these expenses, ensuring you receive the necessary care without financial burden.

How to Choose the Right Travel Insurance

When it comes to selecting a travel insurance plan, there are several key factors to consider to ensure you have the coverage you need for your specific travel needs. Understanding the different add-ons or optional coverage available in travel insurance policies can help tailor a plan that suits your requirements perfectly.

Here are some tips on how to choose the right travel insurance:

Key Factors to Consider

- Destination: Consider the location you are traveling to and the level of medical care available there.

- Trip Duration: Choose a plan that covers the entire duration of your trip, including any unexpected delays.

- Coverage Limits: Ensure the policy offers adequate coverage for medical expenses, trip cancellations, and other potential mishaps.

- Pre-Existing Conditions: Check if the policy covers any pre-existing medical conditions you may have.

Add-Ons and Optional Coverage

- Adventure Sports Coverage: If you plan to engage in activities like skiing or scuba diving, consider adding this coverage.

- Lost Baggage Coverage: Protect your belongings by opting for coverage for lost, stolen, or damaged luggage.

- Emergency Evacuation: In case of a medical emergency, having coverage for emergency evacuation can be crucial.

Tailoring Your Plan

- Assess Your Needs: Evaluate the specific risks you may face during your trip and choose coverage accordingly.

- Compare Plans: Look at different insurance providers and compare the coverage options and premiums to find the best fit for you.

- Customize Your Coverage: Many insurance policies offer customizable options, allowing you to add or remove coverage based on your requirements.

Claims Process for Travel Insurance

When it comes to filing a travel insurance claim, understanding the steps involved and knowing what documents are required is crucial. Additionally, being aware of common reasons why claims may be denied can help travelers avoid potential issues and ensure a smoother claims process.

Steps Involved in Filing a Travel Insurance Claim

- Notify your insurance provider: Contact your insurance company as soon as possible after the incident occurs to inform them of your claim.

- Complete claim forms: Fill out the necessary claim forms provided by your insurance provider, providing accurate and detailed information.

- Submit required documentation: Gather all relevant documents to support your claim, such as police reports, medical records, receipts, and any other proof of expenses incurred.

- Wait for claim assessment: Your insurance provider will review your claim and documentation to determine if it meets the policy's coverage criteria.

- Receive claim decision: Once your claim has been assessed, you will be notified of the decision and the amount of compensation you are entitled to receive.

Documents Required to Make a Claim

- Proof of travel: Itinerary, booking confirmations, and travel tickets.

- Proof of expenses: Receipts for any costs incurred, such as medical bills, hotel accommodations, or transportation.

- Police reports: In case of theft, loss, or any criminal incidents, a police report may be required.

- Medical records: Documentation from healthcare providers detailing the medical treatment received during the trip.

Common Reasons for Denied Travel Insurance Claims and How to Avoid Them

- Pre-existing conditions: Failure to disclose pre-existing medical conditions may result in claim denial. Be transparent about your health history when purchasing a policy.

- Not following policy guidelines: Make sure to adhere to the terms and conditions of your policy, such as reporting incidents promptly and providing accurate information.

- Engaging in risky activities: Some policies may not cover injuries or damages resulting from certain high-risk activities. Read the policy exclusions carefully.

- Missing documentation: Ensure you have all the necessary documents to support your claim to avoid delays or denials.

Concluding Remarks

Concluding our exploration of travelinsured, we have uncovered the significance of being prepared with travel insurance, ensuring peace of mind and financial protection during your adventures. This summary encapsulates the key points discussed, leaving readers with a newfound appreciation for the value of travel insurance.

FAQ Explained

What does travel insurance typically cover?

Travel insurance usually covers trip cancellations, medical emergencies, lost baggage, and travel delays.

Is travel insurance worth it for short trips?

Yes, travel insurance can still be beneficial for short trips, especially if unexpected situations arise.

Can I purchase travel insurance after booking a trip?

Yes, you can usually purchase travel insurance after booking a trip, but it's recommended to do so as early as possible.