Embark on your travel adventures fully prepared with recommended travel insurance. Discover why this type of coverage is essential for travelers looking for peace of mind and optimal protection.

Importance of Recommended Travel Insurance

Traveling can be an exciting and enriching experience, but it also comes with its fair share of risks. This is why having recommended travel insurance is crucial for travelers looking to protect themselves and their belongings during trips.

Benefits of Opting for Recommended Travel Insurance

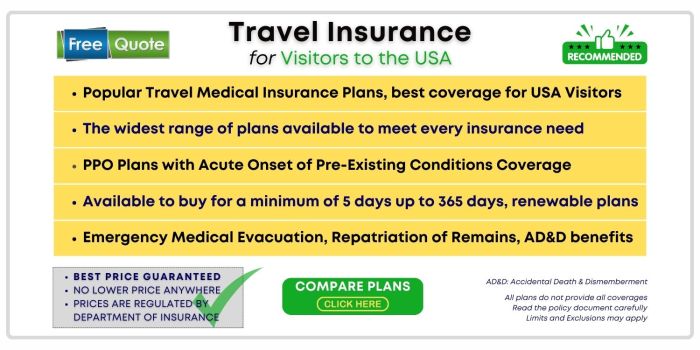

- Enhanced Coverage: Recommended travel insurance typically offers more comprehensive coverage compared to basic plans, including higher limits for medical expenses, trip cancellations, and lost baggage.

- Emergency Assistance: With recommended travel insurance, travelers can access 24/7 emergency assistance services, such as medical referrals, legal assistance, and emergency cash advances.

- Adventure Activities Coverage: Many recommended travel insurance plans cover a wide range of adventure activities, ensuring that travelers can partake in thrilling experiences with peace of mind.

- COVID-19 Coverage: In light of the ongoing pandemic, recommended travel insurance often includes coverage for trip cancellations, interruptions, and medical expenses related to COVID-19.

Peace of Mind During Trips

By opting for recommended travel insurance, travelers can enjoy peace of mind knowing that they are financially protected in case of unforeseen events such as trip cancellations, medical emergencies, or lost belongings. This allows them to focus on enjoying their travels without worrying about potential risks.

Factors to Consider When Choosing Recommended Travel Insurance

When selecting recommended travel insurance, there are several key factors that travelers should consider to ensure they have the appropriate coverage for their trip.

Types of Coverage Included in Recommended Travel Insurance Policies

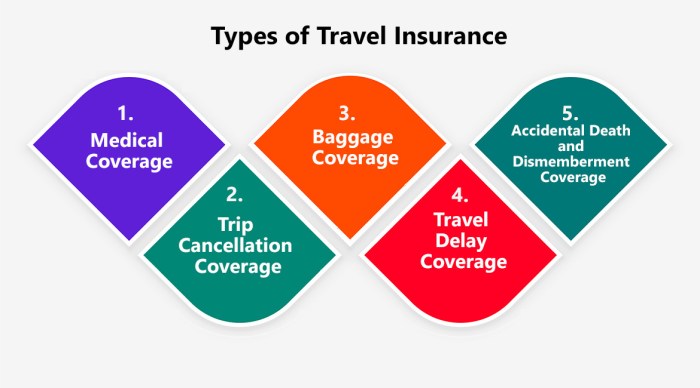

Recommended travel insurance policies typically include the following types of coverage:

- Emergency medical coverage: This covers medical expenses, hospital stays, and emergency medical evacuations during your trip.

- Trip cancellation/interruption coverage: This reimburses you for non-refundable trip costs if your trip is cancelled or cut short due to covered reasons.

- Baggage loss/damage coverage: This provides reimbursement for lost, stolen, or damaged baggage during your trip.

- Travel delay coverage: This reimburses you for additional expenses incurred due to a covered travel delay.

- Emergency assistance services: This includes 24/7 access to assistance services such as medical referrals and travel arrangements.

Assessing the Reputation and Reliability of Insurance Providers

When evaluating insurance providers offering recommended travel insurance, consider the following factors:

- Financial stability: Look for insurers with a strong financial rating to ensure they can fulfill claims.

- Customer reviews: Check online reviews and ratings to gauge the satisfaction levels of other policyholders.

- Claims process: Research how easy and efficient the claims process is with the insurance provider.

- Coverage options: Ensure the insurance provider offers the specific coverage you need for your trip.

- Customer service: Evaluate the responsiveness and helpfulness of the insurance provider’s customer service team.

Coverage Details in Recommended Travel Insurance

Travel insurance policies typically offer a range of coverage options to protect travelers from unforeseen circumstances during their trip. Let’s delve into the common coverage areas included in recommended travel insurance policies.

Medical Expenses Coverage

- Most recommended travel insurance plans cover emergency medical expenses while traveling abroad. This includes hospital stays, doctor visits, and medication costs.

- Example: If you fall ill or get injured during your trip and require medical attention, your travel insurance can cover the expenses, saving you from hefty out-of-pocket costs.

Trip Cancellation and Interruption Coverage

- This coverage reimburses you for prepaid, non-refundable trip expenses if you have to cancel your trip due to a covered reason, such as illness, natural disasters, or other emergencies.

- Example: If you have to cancel your trip at the last minute due to a family emergency, your travel insurance can help recoup the costs of your flights, hotel bookings, and other prepaid expenses.

Baggage and Personal Belongings Coverage

- Travel insurance typically provides coverage for lost, stolen, or damaged baggage and personal belongings during your trip.

- Example: If your luggage gets lost in transit or your valuable belongings are stolen while traveling, your travel insurance can help cover the cost of replacing them.

Emergency Evacuation Coverage

- In case of a medical emergency or natural disaster, travel insurance can cover the expenses associated with emergency evacuation to the nearest adequate medical facility.

- Example: If you suffer a serious injury in a remote location and need to be airlifted to a hospital for treatment, your travel insurance can cover the costly evacuation fees.

Exclusions and Limitations

- It’s crucial to carefully read the policy documents to understand any exclusions or limitations of your travel insurance coverage.

- Common exclusions may include pre-existing medical conditions, high-risk activities, and certain destinations under travel advisories.

- Limitations may apply to coverage amounts, duration of the trip, and specific circumstances under which claims can be made.

Cost Considerations and Budgeting for Recommended Travel Insurance

When planning a trip, budgeting for recommended travel insurance is an essential part of ensuring a smooth and worry-free travel experience. Understanding the cost factors and how to balance them with the level of coverage needed can help travelers make informed decisions.

Factors Affecting the Cost of Recommended Travel Insurance

- The destination plays a significant role in determining the cost of travel insurance. Some countries have higher healthcare costs, leading to more expensive insurance premiums.

- The duration of the trip is another crucial factor. Longer trips typically require higher premiums due to the extended coverage period.

- The level of coverage desired by the traveler also impacts the cost. Comprehensive coverage including medical expenses, trip cancellation, and baggage loss will be more expensive compared to basic coverage.

Tips for Budgeting for Recommended Travel Insurance

- Start by researching different insurance providers to compare prices and coverage options. Look for packages that offer the best value for your specific needs.

- Consider the activities you plan to engage in during your trip. Some adventurous activities may require additional coverage, so factor this into your budget.

- Set aside a specific portion of your overall trip budget for travel insurance. Treat it as a non-negotiable expense to ensure you have adequate protection.

- Look for discounts or promotions that insurance companies may offer. Sometimes, bundling insurance with other travel services can lead to cost savings.

Final Thoughts

In conclusion, recommended travel insurance is the key to ensuring a worry-free journey. By understanding the importance, factors to consider, coverage details, and cost considerations, travelers can make informed decisions to safeguard their trips.

Common Queries

What sets recommended travel insurance apart from basic coverage?

Recommended travel insurance offers enhanced benefits and coverage options compared to basic plans, providing travelers with comprehensive protection.

How can travelers assess the reputation of insurance providers offering recommended travel insurance?

Travelers can research online reviews, ratings, and customer feedback to gauge the reliability and reputation of insurance providers.

Are there any specific scenarios where recommended travel insurance proves to be particularly beneficial?

Recommended travel insurance is especially useful in cases of trip cancellations, medical emergencies abroad, and lost luggage incidents.

How does the cost of recommended travel insurance vary based on different factors?

The cost of recommended travel insurance depends on variables like destination, trip duration, coverage level, and the traveler’s age and health.

Is it possible to customize recommended travel insurance plans according to individual needs?

Yes, travelers can often tailor recommended travel insurance plans to suit their specific requirements by adding or removing coverage options.