Exploring the world on a cruise is an exciting adventure, but ensuring you have the best travel insurance for cruises is essential for a worry-free trip. From unexpected medical emergencies to trip cancellations, having the right coverage can make all the difference.

Let’s dive into the details of what to consider when selecting the perfect travel insurance plan for your cruise vacation.

Importance of Travel Insurance for Cruises

Travel insurance for cruises is an essential aspect of trip planning that should not be overlooked. While embarking on a cruise vacation can be exciting, unforeseen circumstances can disrupt your plans and lead to financial losses. Having the right travel insurance coverage can provide peace of mind and protect you from potential risks that may arise during your cruise.

Potential Risks Mitigated by Travel Insurance

- Medical Emergencies: In the event of a medical emergency onboard or at a port of call, travel insurance can cover medical expenses, including evacuation if needed.

- Trip Cancellation or Interruption: If you need to cancel or cut short your cruise due to unforeseen reasons like illness, travel insurance can help reimburse you for non-refundable expenses.

- Missed Connection: Travel insurance can provide coverage if you miss your cruise departure due to a flight delay or cancellation, ensuring you can catch up with the cruise at the next port.

- Lost or Delayed Baggage: In case your luggage is lost or delayed during your trip, travel insurance can compensate you for essential items needed during the cruise.

Examples of Situations Where Travel Insurance is Beneficial

- A passenger falls ill during the cruise and requires emergency medical treatment, including evacuation to a medical facility on land.

- Severe weather conditions force the cruise ship to change its itinerary, causing you to miss out on prepaid excursions. Travel insurance can help cover the cost of these missed activities.

- Your flight to the cruise departure port is canceled, leading to a missed connection with the cruise ship. Travel insurance can assist in rebooking transportation to catch up with the cruise.

Factors to Consider When Choosing Travel Insurance for Cruises

When selecting travel insurance for a cruise, there are specific factors that you should consider to ensure you have adequate coverage for your trip. It is essential to compare different insurance plans available and choose one that meets your needs.

Here are some key factors to keep in mind:

Coverage Options for Cruise Travel

- Medical Coverage: Make sure the insurance plan includes coverage for medical emergencies, including evacuation from the ship if needed.

- Trip Cancellation/Interruption: Look for coverage that reimburses you for non-refundable expenses if you have to cancel or cut your trip short due to covered reasons.

- Missed Connection: This coverage helps if you miss the departure of your cruise due to a covered reason, such as a flight delay.

- Baggage Loss/Delay: Ensure the plan provides coverage for lost, stolen, or delayed baggage during your trip.

- Emergency Assistance: Check if the insurance offers 24/7 emergency assistance services while you are on your cruise.

Comparison of Insurance Plans

- Cost: Compare the premiums and deductibles of different insurance plans to find one that fits your budget.

- Coverage Limits: Check the maximum limits for each coverage type to ensure they are sufficient for your needs.

- Pre-Existing Conditions: Some plans may exclude coverage for pre-existing medical conditions, so review this carefully if applicable.

- Add-On Options: Look for additional coverage options, such as cancel for any reason or adventure sports coverage, depending on your preferences.

Tips for Selecting the Best Travel Insurance

- Start Early: Purchase travel insurance as soon as you book your cruise to take advantage of pre-departure coverage benefits.

- Read the Fine Print: Carefully review the policy details, including exclusions and limitations, to understand what is covered.

- Consult with a Professional: Consider speaking with a travel insurance expert to help you navigate the different options and choose the best plan for your cruise.

- Consider Your Needs: Assess your specific travel needs and risks to select a policy that provides adequate coverage for your cruise.

Coverage Details

When it comes to travel insurance for cruises, understanding the coverage details is crucial to ensure you are adequately protected throughout your trip. There are typically two main types of coverage included in most travel insurance plans for cruises: medical coverage and trip cancellation coverage.

Medical Coverage vs. Trip Cancellation Coverage

Medical coverage in a cruise travel insurance policy provides financial protection in case you need medical attention while on your cruise, including coverage for emergency medical treatment, medical evacuation, and repatriation. On the other hand, trip cancellation coverage reimburses you for non-refundable expenses if you have to cancel your cruise due to covered reasons such as illness, injury, or other unforeseen events.

Comprehensive Cruise Travel Insurance Policy

A comprehensive cruise travel insurance policy should include a range of coverage options to ensure you are adequately protected throughout your trip. Some key components that a comprehensive policy should include are:

- Emergency medical coverage for illnesses or injuries during the cruise

- Medical evacuation coverage to transport you to the nearest adequate medical facility

- Trip cancellation coverage for unforeseen events that force you to cancel your cruise

- Trip interruption coverage in case your cruise is disrupted and you need to return home early

- Baggage loss or delay coverage for lost, stolen, or delayed luggage

- Travel delay coverage for additional expenses due to delayed flights or other travel disruptions

- Emergency assistance services for 24/7 support during your cruise

Having a comprehensive cruise travel insurance policy that includes these coverage options can provide you with peace of mind and financial protection while enjoying your cruise vacation.

Top Providers in the Market

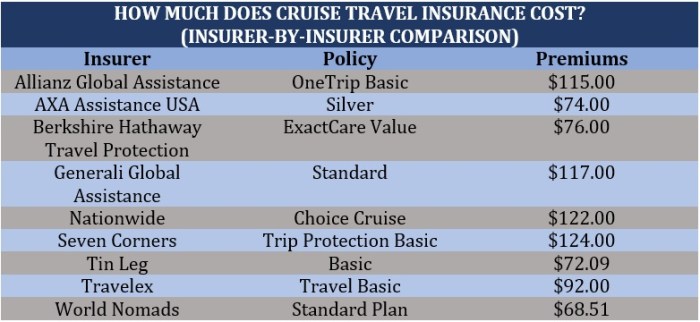

When it comes to choosing the best travel insurance for cruises, it’s essential to consider the top providers in the market. These insurance companies offer specialized coverage tailored to the unique needs of cruise travelers. Let’s take a closer look at some popular insurance providers and compare their offerings in terms of benefits and pricing.

Allianz Global Assistance

Allianz Global Assistance is a well-known insurance provider that offers specific cruise travel insurance plans. Their coverage includes trip cancellation, trip interruption, emergency medical expenses, and baggage loss or delay. Customers praise their excellent customer service and efficient claims process.

Pricing varies based on the coverage selected and the traveler’s age and trip cost.

Travel Guard

Travel Guard is another reputable insurance company that provides comprehensive coverage for cruise vacations. Their plans include trip cancellation, emergency medical coverage, baggage protection, and 24/7 travel assistance. Customers appreciate their competitive pricing and the wide range of coverage options available.

Reviews highlight their quick response to claims and overall satisfaction with the service.

Travelex Insurance Services

Travelex Insurance Services offers specialized cruise insurance plans that cater to the needs of cruise travelers. Their coverage includes trip cancellation, emergency medical coverage, baggage protection, and travel assistance services. Customers value their flexible coverage options and prompt claim processing.

Pricing depends on the plan selected and the traveler’s age and trip details.

Conclusion

In conclusion, selecting the best travel insurance for cruises is a crucial step in planning your next voyage. By understanding the importance of coverage options, comparing different plans, and knowing what to look for in a policy, you can embark on your cruise with confidence and peace of mind.

Bon voyage!

FAQ Compilation

What risks can travel insurance mitigate for cruise trips?

Travel insurance can help cover costs associated with trip cancellations, medical emergencies, lost luggage, and unexpected interruptions during your cruise.

How do I choose the best travel insurance for cruises?

Consider factors like coverage options, trip duration, medical coverage, trip cancellation benefits, and emergency assistance services when selecting a travel insurance plan for cruises.

What does a comprehensive cruise travel insurance policy include?

A comprehensive policy should include coverage for trip cancellations, medical emergencies, emergency medical evacuation, trip interruption, baggage loss, and 24/7 travel assistance.