Diving into the realm of CSA Travel Protection, this introduction aims to provide a comprehensive overview of the topic, shedding light on its significance and practical applications.

The subsequent paragraph will delve into the specifics of what CSA Travel Protection entails and how it can benefit travelers.

Overview of CSA Travel Protection

CSA Travel Protection is a leading provider of travel insurance and assistance services, offering coverage for a wide range of travel-related issues. Whether you're planning a vacation, business trip, or study abroad program, CSA Travel Protection can provide peace of mind and financial protection in case of unexpected events.

Main Features of CSA Travel Protection

- Trip Cancellation Coverage: Reimburses you for non-refundable trip costs if you have to cancel due to a covered reason.

- Emergency Medical and Dental Coverage: Provides coverage for medical emergencies while traveling, including hospital stays, surgeries, and medications.

- Baggage and Personal Effects Coverage: Reimburses you for lost, stolen, or damaged luggage and personal belongings.

- 24/7 Emergency Assistance: Access to a team of professionals who can help with medical emergencies, travel arrangements, and more.

Types of Coverage Offered by CSA Travel Protection

- Travel Delay Coverage: Reimburses you for additional expenses due to covered delays, such as hotel stays and meals.

- Rental Car Damage Coverage: Provides reimbursement for damages to a rental car while in your possession.

- Trip Interruption Coverage: Reimburses you for the unused portion of your trip if you have to cut it short due to a covered reason.

Examples of Situations Where CSA Travel Protection Can Be Beneficial

- You have to cancel your trip at the last minute due to a sudden illness.

- Your luggage is lost during a layover, and you need to purchase essential items.

- A family emergency forces you to return home early from your vacation.

Benefits of CSA Travel Protection

CSA Travel Protection offers a range of benefits that can provide peace of mind during your travels.

Comprehensive Coverage

- CSA Travel Protection offers coverage for trip cancellations, interruptions, and delays due to unforeseen circumstances such as illness, injury, or severe weather.

- Other benefits include coverage for emergency medical expenses, baggage loss or delay, and rental car damage.

24/7 Assistance

- CSA Travel Protection provides round-the-clock assistance for travel emergencies, ensuring you have access to help whenever you need it.

- Their customer service team can assist with medical referrals, travel arrangements, and emergency cash transfers.

Price Comparison

- When compared to other travel insurance options, CSA Travel Protection often offers competitive pricing with comprehensive coverage.

- Their flexible plans allow you to choose the coverage that best fits your travel needs and budget.

Real-Life Scenarios

- One traveler shared how CSA Travel Protection helped cover the costs of a canceled trip due to a family emergency, providing a refund for non-refundable expenses.

- In another scenario, CSA Travel Protection assisted a traveler with medical evacuation and repatriation after a serious injury abroad, ensuring they received the necessary care and transport home.

How to Purchase CSA Travel Protection

When planning your next trip, it's important to consider purchasing travel insurance to protect yourself from unexpected events. CSA Travel Protection offers a range of plans to suit different needs and budgets

Choose the Right Plan

- Start by assessing your travel needs - consider factors like trip cost, destination, duration, and activities planned.

- Review the different plans offered by CSA Travel Protection, such as the Essential, Deluxe, and Custom plans, each providing varying levels of coverage.

- Compare the benefits and coverage limits of each plan to determine which one aligns best with your travel requirements.

Purchasing Process

- Visit the CSA Travel Protection website or contact their customer service to start the purchasing process.

- Enter your trip details, including travel dates, destination, and trip cost, to receive a quote for the available plans.

- Review the quote provided, ensuring it covers all the necessary aspects of your trip and offers the desired level of protection.

- Select the plan that meets your needs and proceed to purchase it by completing the required information and payment.

Tips for Purchasing

- Consider any pre-existing medical conditions or activities not covered by standard plans and opt for additional coverage if needed.

- Read the policy documents carefully to understand the terms, conditions, and exclusions of the chosen plan.

- Check for any specific coverage related to COVID-19, trip cancellations, delays, medical emergencies, and baggage protection.

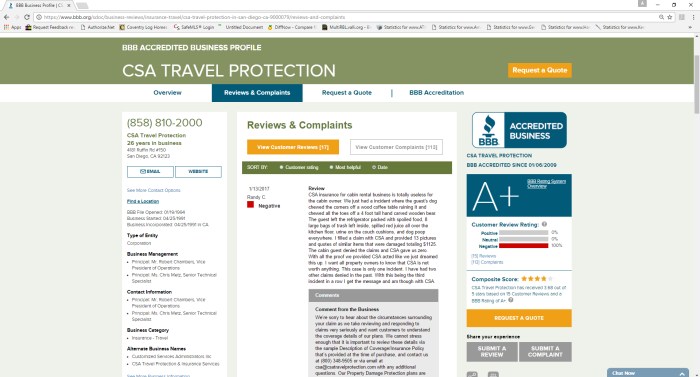

Claims Process with CSA Travel Protection

When unfortunate incidents occur during your travels, filing a claim with CSA Travel Protection can help you recover expenses and receive assistance. Here's a detailed look at the claims process with CSA Travel Protection.

Filing a Claim

- Contact CSA Travel Protection as soon as possible after the incident to initiate the claims process.

- Fill out the necessary claim forms provided by CSA Travel Protection, ensuring all information is accurate and complete.

- Submit any relevant documentation to support your claim, such as receipts, medical records, police reports, and proof of trip interruption or cancellation.

Documentation Required

- Proof of travel insurance purchase

- Details of the incident or reason for the claim

- Receipts for expenses incurred

- Medical reports, if applicable

Tips for Expedited Claims Process

- Ensure all documentation is submitted promptly and accurately to avoid delays in processing your claim.

- Stay in communication with CSA Travel Protection representatives to provide any additional information or clarification they may require.

- Follow up on the status of your claim periodically to stay informed of any updates or requests for further information.

Conclusion

In conclusion, CSA Travel Protection emerges as a valuable asset for travelers seeking peace of mind and financial security during their journeys.

FAQ Summary

What does CSA Travel Protection cover?

CSA Travel Protection provides coverage for trip cancellation, trip interruption, travel delay, baggage loss, and medical emergencies.

How do I purchase CSA Travel Protection?

You can purchase CSA Travel Protection online through their website by selecting a plan, entering trip details, and making a payment.

Can I file a claim with CSA Travel Protection after my trip has ended?

Yes, you can file a claim with CSA Travel Protection within a certain timeframe after your trip has ended, usually within a specified number of days.