As the world grapples with the impacts of COVID-19 on travel plans, understanding the nuances of travel insurance for COVID cancellation becomes crucial. This article delves into the intricacies of coverage, exclusions, and benefits, shedding light on a topic that has become increasingly relevant in today's uncertain times.

Overview of Travel Insurance for COVID Cancellation

Travel insurance for COVID cancellation has become increasingly important in the current travel landscape. With the uncertainty surrounding the pandemic and its impact on travel plans, having the right insurance coverage can provide peace of mind and financial protection.One of the main benefits of travel insurance for COVID cancellation is the coverage it offers in case you need to cancel or postpone your trip due to COVID-19 related reasons.

This can include contracting the virus yourself, a family member falling ill, travel restrictions imposed by the government, or quarantine requirements at your destination.

Key Features of Travel Insurance Policies

- Trip Cancellation Coverage: This feature allows you to recoup your non-refundable trip costs if you need to cancel your trip due to COVID-19 reasons.

- Emergency Medical Coverage: Some policies offer coverage for medical expenses if you were to contract COVID-19 while traveling.

- Cancel for Any Reason (CFAR) Coverage: While not all policies offer this, CFAR coverage allows you to cancel your trip for any reason, including concerns related to COVID-19, and receive a partial refund.

- Travel Assistance Services: Many policies provide 24/7 assistance services to help you navigate any COVID-related issues that may arise during your trip.

Coverage Details

Travel insurance policies typically cover the following aspects related to COVID-19 cancellations:

Refund for Cancelled Trips

- Most travel insurance policies provide coverage for trip cancellations due to COVID-19, including illness, quarantine requirements, or travel restrictions.

- Refunds are usually offered for prepaid, non-refundable expenses such as flights, accommodation, and tours.

- Check the policy for specific terms and conditions regarding coverage and reimbursement limits.

Medical Coverage

- Some travel insurance plans include medical coverage for COVID-19 treatment while traveling, including hospitalization and emergency medical expenses.

- Review the policy to understand the extent of medical coverage and any exclusions related to COVID-19.

Travel Assistance

- Many insurance providers offer 24/7 travel assistance services for COVID-related emergencies, such as locating medical facilities or arranging medical evacuations.

- Ensure you have access to the provider's assistance hotline and understand the support available in case of COVID-related issues during your trip.

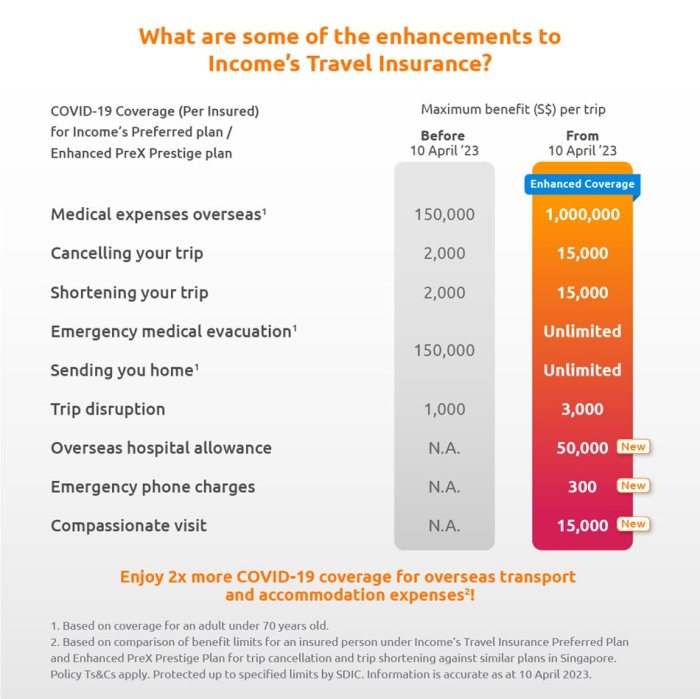

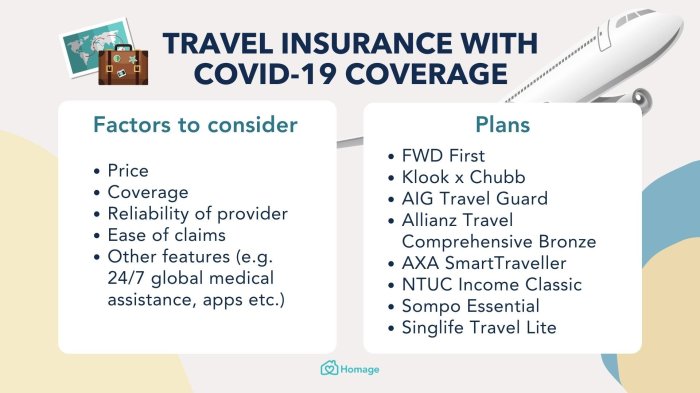

Comparison of Insurance Providers

- When selecting a travel insurance policy, compare different providers based on their coverage for COVID-related cancellations, including refund policies, medical coverage, and travel assistance services.

- Consider the reputation and financial stability of the insurance company to ensure reliable coverage in case of cancellations due to COVID-19.

Exclusions and Limitations

- Some travel insurance policies may have exclusions or limitations related to COVID-19 cancellations, such as pre-existing medical conditions, government travel advisories, or high-risk destinations.

- Read the policy documents carefully to understand any specific exclusions or limitations that may impact coverage for COVID-related cancellations.

Process and Requirements

When it comes to filing a claim for COVID-related cancellations with your travel insurance, there are specific steps and requirements you need to be aware of. It's important to understand the process thoroughly to ensure a smooth claims experience.

Filing a Claim for COVID-related Cancellations

- Notify your travel insurance provider as soon as possible about the cancellation due to COVID.

- Gather all necessary documentation, including proof of cancellation, medical documents if applicable, and any other supporting evidence.

- Fill out the claim form accurately and provide all requested information to expedite the process.

- Be prepared to provide details about your travel plans, the reason for cancellation, and any other relevant information requested by the insurance company.

Documentation and Requirements for Claim Coverage

- Proof of travel booking and cancellation, such as flight tickets, hotel reservations, and tour bookings.

- Medical documents if the cancellation is due to illness or quarantine related to COVID-19.

- Any communication with airlines, hotels, or other travel providers regarding the cancellation.

- Receipts for any non-refundable expenses incurred due to the cancellation.

Tips for a Smooth Claims Process

- Keep all documentation organized and easily accessible to provide to the insurance company promptly.

- Follow up with your insurance provider regularly to ensure that your claim is being processed and to provide any additional information if needed.

- Double-check all information on the claim form to avoid delays or issues with processing.

- Stay informed about your policy coverage and any specific requirements for COVID-related claims to avoid misunderstandings.

Benefits and Drawbacks

Travel insurance for COVID cancellations offers several benefits that can provide peace of mind and financial protection to travelers. However, there are also some drawbacks and limitations to consider when relying on travel insurance in such situations.

Benefits of Travel Insurance for COVID Cancellations

- Financial Protection: Travel insurance can help recoup the costs of non-refundable bookings in case of trip cancellations due to COVID-related reasons.

- Emergency Medical Coverage: Some travel insurance policies also offer coverage for emergency medical expenses related to COVID-19 while traveling.

- Trip Interruption Coverage: In the event of a trip interruption due to COVID-19, travel insurance can help cover additional expenses incurred for unexpected accommodation or transportation.

- Peace of Mind: Knowing that you have coverage in case of COVID-related cancellations can provide peace of mind and reduce travel-related stress.

Drawbacks and Limitations of Travel Insurance for COVID Cancellations

- Exclusions and Limitations: Some travel insurance policies may have specific exclusions or limitations related to COVID-19 coverage, so it is important to carefully review the policy details.

- Claim Approval Process: The process of filing and receiving approval for a claim related to COVID cancellations can sometimes be lengthy and require extensive documentation.

- Cost Considerations: Travel insurance premiums for COVID coverage may be higher than standard policies, adding to the overall cost of the trip.

- Changing Regulations: Travel restrictions and regulations related to COVID-19 are constantly evolving, which can impact the coverage and validity of travel insurance policies.

Real-Life Example:

John had booked a dream vacation to Europe but had to cancel his trip last minute due to a positive COVID-19 test result. Thanks to his comprehensive travel insurance policy, he was able to recover the majority of his non-refundable expenses, including flights and accommodation costs.

Last Point

In conclusion, travel insurance for COVID cancellation serves as a valuable safety net in uncertain times, offering peace of mind and financial protection for travelers. By exploring the details of coverage, processes, and real-life examples, individuals can make informed decisions to safeguard their travel plans amidst the ever-evolving landscape of the pandemic.

Essential FAQs

What does travel insurance for COVID cancellation typically cover?

Travel insurance for COVID cancellation usually covers trip interruptions, cancellations, and medical emergencies related to the virus.

Are there any specific exclusions to be aware of when it comes to COVID-related cancellations?

Some travel insurance policies may exclude coverage for pandemics or known events at the time of booking.

What documents are required to file a claim for COVID-related cancellations?

Documentation such as medical certificates, trip itineraries, and proof of cancellation may be needed to claim coverage.

What are the benefits of having travel insurance for COVID cancellations?

Travel insurance provides financial protection and peace of mind in case unexpected cancellations or disruptions occur due to the pandemic.

Can you provide a real-life example of how travel insurance has helped with COVID cancellations?

One traveler was able to recoup their non-refundable trip costs when they had to cancel their vacation due to testing positive for COVID-19 before departure.